Income Tax Limits 2025. The irs increased its tax brackets by about 5.4% for each type of tax filer for 2025, such as those filing separately or as married couples. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

The federal income tax has seven tax rates in. Toward the end of 2025 the irs increased the income amounts for the 7 tax brackets to account for inflation.

The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Roth Contribution Limits 2025 Minda Lianna, The 2025 tax year features seven federal tax bracket percentages: Toward the end of 2025 the irs increased the income amounts for the 7 tax brackets to account for inflation.

ACA / Tax Credits to Help Pay Premiums White Insurance Agency, You pay tax as a percentage of your income in layers called tax brackets. A handful of tax provisions, including the standard deduction and tax brackets, will see.

401k And Roth Ira Contribution Limits 2025 Cammy Caressa, 199a qualified business income deduction. You pay tax as a percentage of your income in layers called tax brackets.

2019 tax brackets california and federal, The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808. New 2025 income tax brackets and a higher standard deduction may mean tax cuts for many americans.

FAQ WA Tax Credit, The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808. Plus, there's good news for savers:

Wheda Limits 2025 Sonni Olympe, Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax rate schedules and other tax changes. It also made inflation adjustments to contributions limits.

.png)

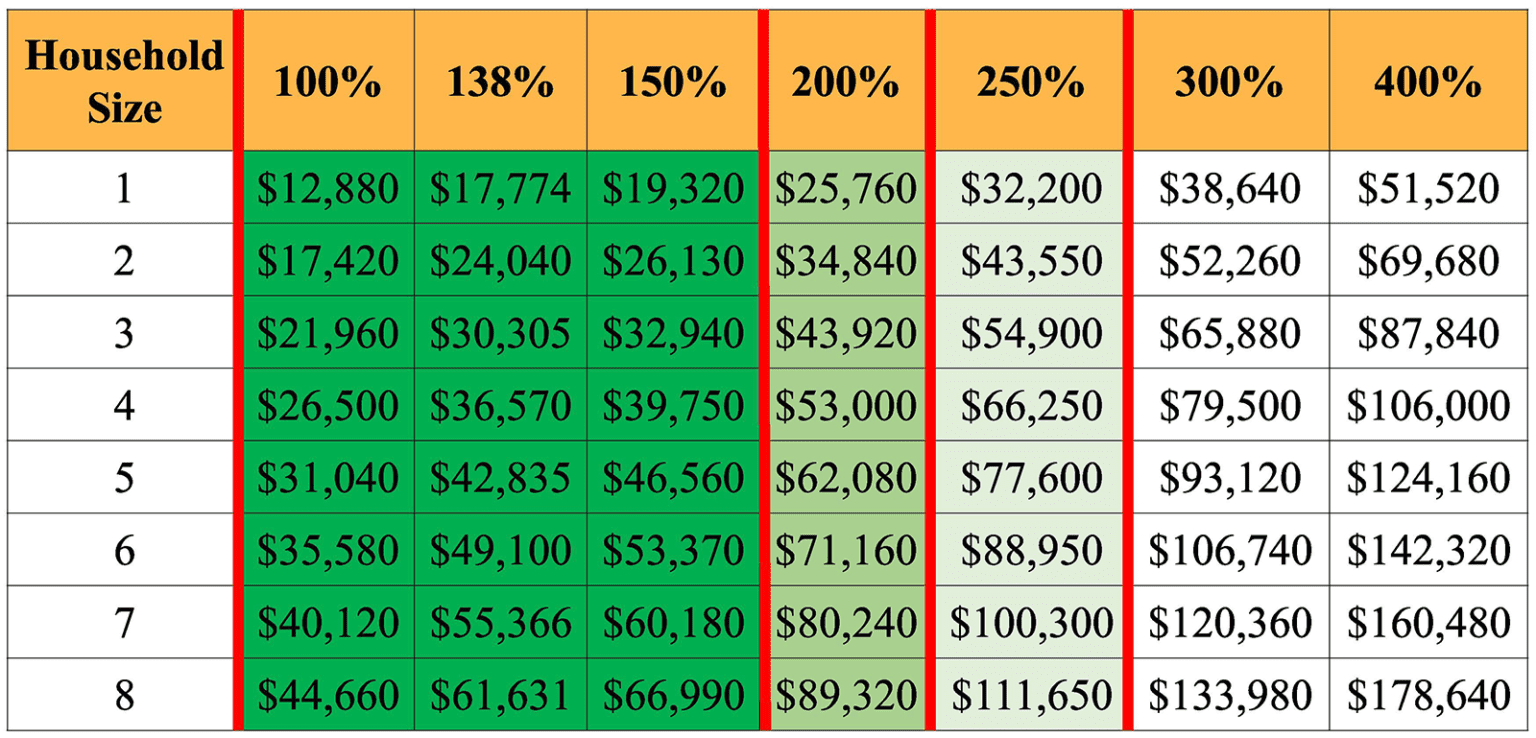

Health Insurance Limits for 2025 to receive ACA premium s, The income up to $11,600 will be taxed at 10%, yielding $1,160. The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The internal revenue service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2025 tax year. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Medicare Blog Moorestown, Cranford NJ, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

![Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2023/02/how-to-calculate-income-tax-2023-24-excel-income-tax-calculation-examples-video-1024x576.webp)

Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog, For 2025, taxpayers with taxable income above $191,900 for single and head. The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.