Social Security Salary Cap 2025 Changes. In 2025, the taxable earnings cap is $168,600. But in 2025, it's likely to rise.

Workers are required to pay federal taxes that support social security, with employees contributing 6.2 percent and employers matching this rate. News january 02, 2025 at 05.

Social Security Max Allowed 2025 2025 Matt Baker, I'll kick off next year's social security changes with one of the most anticipated updates.

2025 Social Security Changes Fact Sheet Kevin Short, Retirees can expect to see some big changes in 2025 when it comes to their social security and medicare benefits.

Unveiling the 2025 Social Security Increase What You Need to Know, The social security administration (ssa) has announced that the maximum earnings subject to the social security payroll tax will increase by $7,500 in 2025.

Here's how different salaries can drastically raise or lower your, The social security administration (ssa) has announced that the maximum earnings subject to the social security payroll tax will increase by $7,500 in 2025.

Social Security Spreadsheet Fun Bankers Anonymous, (the 2025 tax limit is $168,600.) this 4.4% increase is less than the 5.2% jump from 2025 to 2025.

2025 Fica Tax Rates And Limits 2025 VGH, President joe biden is expected to sign a bill that will.

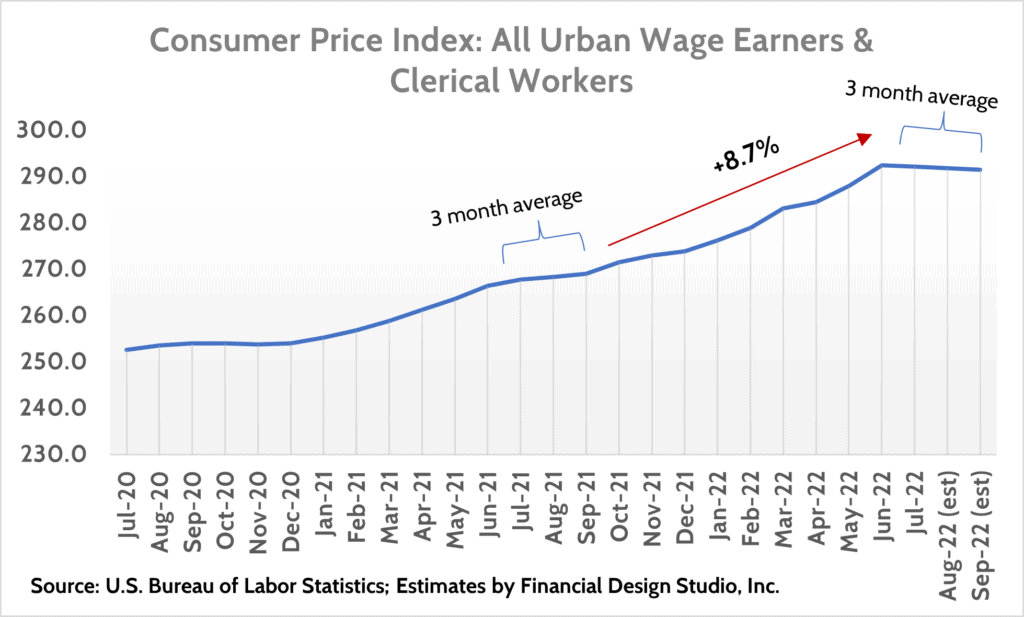

Social Security Cost of Living Increase Financial Design Studio, Inc, The maximum amount of earnings subject to the social security tax (taxable maximum) will increase to $176,100, from $168,600 in 2025.

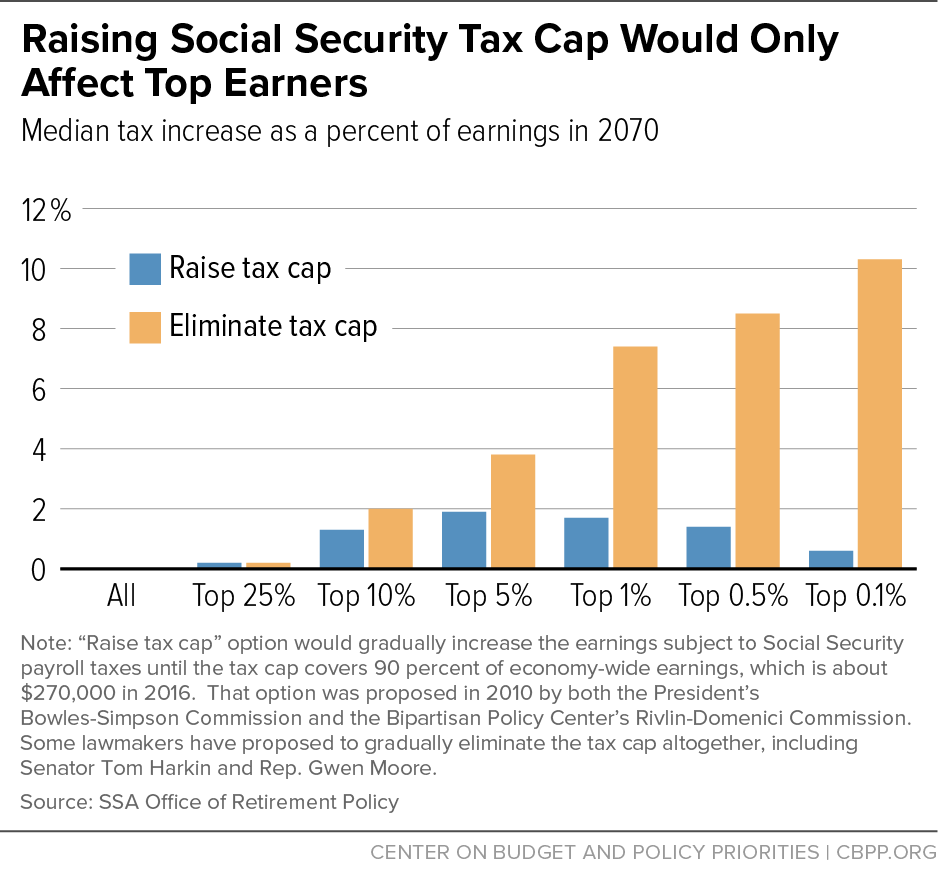

Raising Social Security Tax Cap Would Only Affect Top Earners Center, In 2025, this cap will rise to.

Social Security Administration Salaries Comparably, In 2025, the taxable earnings cap is $168,600.